General ledger accounts (GLs) are account numbers used to categorize types of financial transactions. Most GLs are revenues, expenses, and transfers. A “chart of accounts” is a complete listing of every GL account in an accounting system.

Many Names, Same Information

GL, General Ledger, Cost Element, Commitment Item, Revenue Element, Account -- at the University, all of these terms are names for the same thing – a general ledger account or GL. In SAP, GLs are known as “cost elements.” The BCS budgeting system and Business Intelligence reports call them “commitment items.”

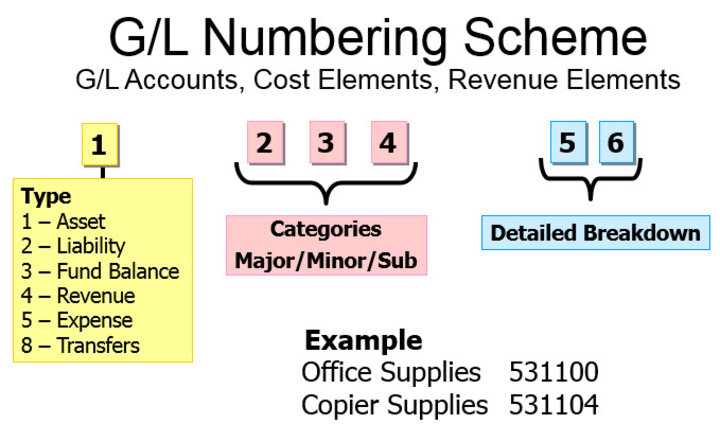

GLs are 6 digits long and each digit provides information.

- The first digit identifies the type of transaction: Revenue postings start with 4; Expense postings start with 5. A GL starting with an 8 is a transfer of funds from one area of UNL to another -- usually from one funding source to another – and occurs infrequently.

- The second, third and fourth digits represent the major, minor and subcategories of what the transaction paid for (expense) or was received for (revenue);

- The fifth/sixth allow for a more detailed breakdown of what the transaction was for.

Expense Example

The best way to learn how to assign a GL is to become familiar with the Chart of Accounts tables. For example, if a department purchased pens, the person coding the expense would review the Expense Chart of Accounts to determine which GL to assign to the purchase. The purchased item may be categorized in a general G/L or using a more specific G/L, if a detailed-level of data is needed. Each additional G/L digit adds specificity. For example, the numbers in GL 531100 indicate the following: 5 indicates an expense transaction, 53xxxx is operating supplies, 531xxx is general supplies and 531100 is office supplies. An office supply purchase may be posted to the GL of 531100, or to a more specific category in that range. For example, if a department needed to track how much was spent on pens, they would use G/L 531107 for those expenditures.

Tips for Use

- All G/L accounts that start with a 5 are for recording expenditures. All disbursements for the procurement of goods or services must be recorded using an account from this group.

- Expenses that are refunded by an outside source due to return of merchandise or overpayment should be coded to the original expense code.

- Disbursements for refunds of revenue should be coded to an appropriate G/L account that starts with a 4, which indicates "revenue."

- Expenses that are reimbursed by a third party should be coded as a revenue rather than a minus expense.

Resources

The following resources are available in Sapphire. Viewing requires TrueYou authentication.

- The most used documents are: Expenditures, Revenues and Transfers -- If you open these documents electronically, you can then use the keyboard shortcut “Control F” to find something in the electronic file, rather than printing the document and manually searching pages.

- The GL Account Code Structure summarizes GL categories.

- Detailed lists of all GLs and additional documentation may be found in the Sapphire folder found at SAP Documentation>Financial.