A time coordinator’s work to audit BW payroll begins the day after the last day of a BW pay period (see UNL Qrtly Payroll Processing Schedule).

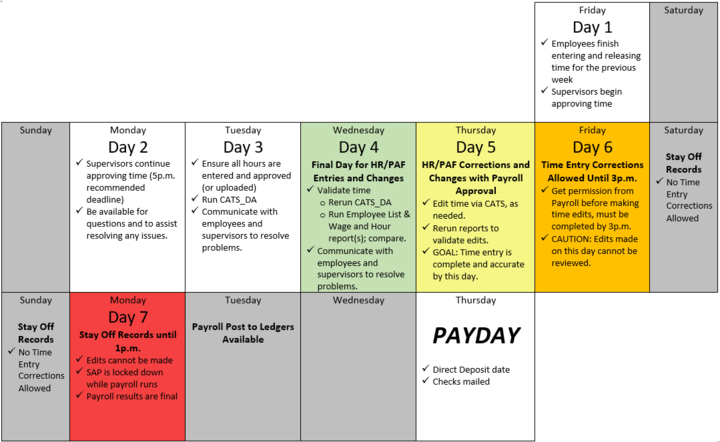

7 Days for a Perfect BW Payroll

The following calendar includes a list of daily tasks for the time coordinator to successfully complete the BW time auditing process.

The following lists some of the things to look for when reviewing the Wage and Hour report for BW employees:

- FTE is met for leave-eligible employees

- Holidays are entered on correct dates

- Employees with no hours

- Missing time/leave entry

- Failing in the time eval process

- Funding source is correct

- Leave payouts are on the employee’s final check

- CME used (check for Comp Time Agreement)

- NRA students working more than weekly limit based on work permit

- Four or more consecutive days of SCK time, possible FML-covered event

Create an Internal Spreadsheet

Some departments create and maintain an internal spreadsheet of the staff for whom they are responsible for auditing BW payroll. It is recommended that this spreadsheet is regularly audited against a BI Employee List to ensure accuracy. The spreadsheet is used to help track various items that cannot all be found in one system report. An example template can be found in SAPPHIRE (direct download). Time coordinators may create their own or download and modify the example to best fit their needs. In the example, a new tab is created for each BW pay period. It is important that time coordinators are in frequent communication with the HR coordinator (or individual within their department that processes PAFs) so they are aware when any of the data maintained on the spreadsheet changes.