The U.S. has income tax treaties with several foreign countries. Under these treaties, residents (not necessarily citizens) of foreign countries may be eligible to be taxed at a reduced rate or exempt from U.S. income taxes on certain items of income they receive from sources within the U.S. These reduced rates and exemptions vary among countries and specific items of income.

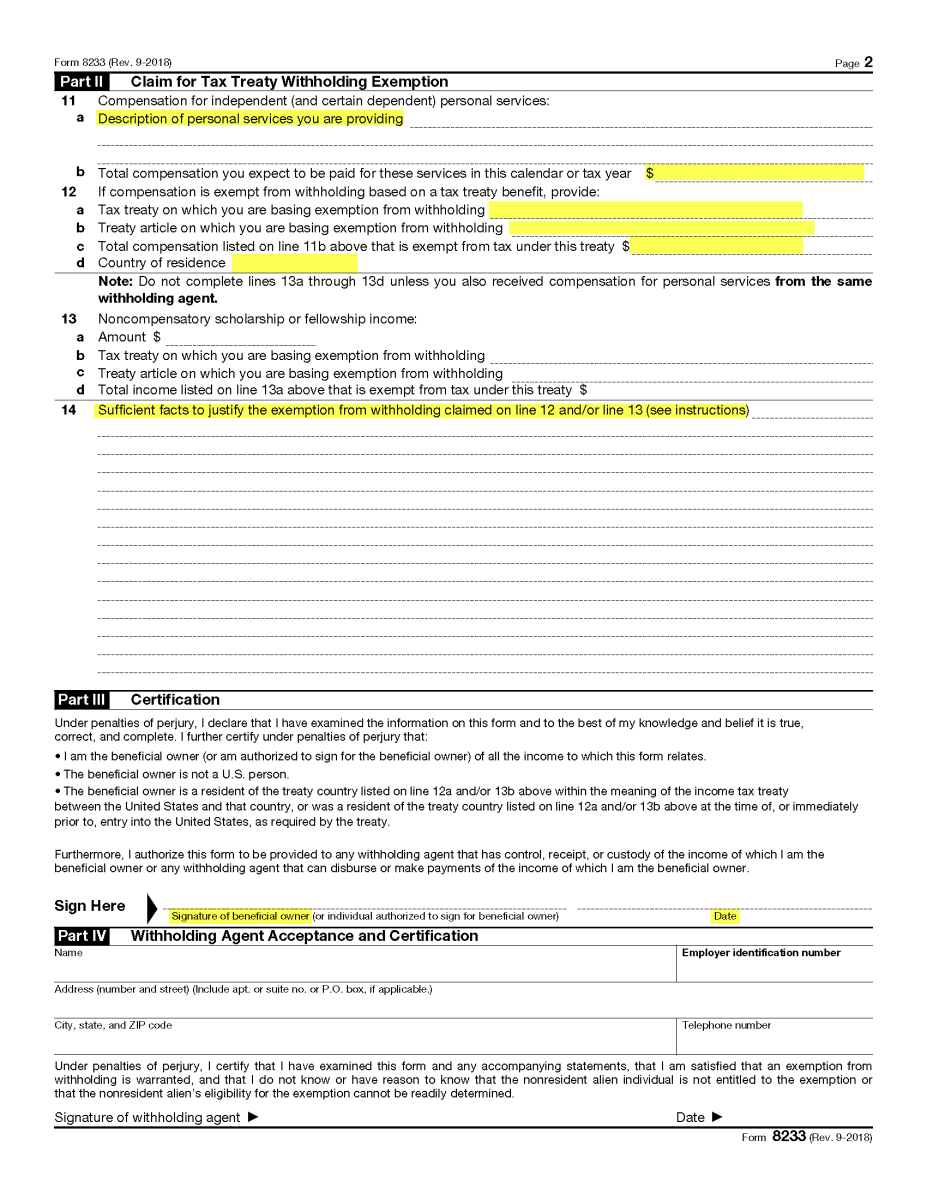

Employees who qualify for a tax treaty and want to claim the benefits must fill out Form 8233 or Form W-8 BEN. For income earned from personal services, the payee files Form 8233, and for income that is not earned from personal services, the payee files Form W-8 BEN. A Revenue Procedure Letter (commonly referred to as a Tax Treaty Statement or Article) is also required to accompany Form 8233.

The University will not process tax treaties through Payroll Services for NRAs that have met or will meet the Substantial Presence Test (SPT) within the current calendar year or that are in a benefits eligible position. The NRA employee can file for tax treaty benefits on their US Tax Return. Then, should the IRS deem qualified, the NRA will receive tax treaty benefits through an IRS Tax Refund.

Business Centers are responsible for notifying new hire NRA’s who qualify for tax treaties and must take the following steps:

- Review the UNL Tax Treaty Table in SAPPHIRE (direct download) to confirm the employee qualifies based on their country of citizenship.

- Qualifying employees should complete Form 8233 (direct download) and the appropriate UNL Tax Treaty Statement/Article as determined by their country of citizenship (link to folder in SAPPHIRE)

OR

Form W-8 BEN (direct download)

- Completed Form 8233 and the UNL Tax Treaty Statement/Article, or Form W-8 BEN, must be included within the NRA documents submitted to Payroll Services and the originals must be mailed to Payroll Services; 401 ADMS, 68588-0436.

Information from an employee's Tax Treaty is populated in SAP infotype IT0556.

Form 8233 Instructions can be found in SAPPHIRE (direct download) or the Internal Revenue Service website The appropriate Tax Treaty Statement, based on the employee's country of permanent residence, should be given to and completed by the employee and included with Form 8233. Statements for Students, SAPPHIRE (access folder) Statements for Teachers or Researchers, SAPPHIRE (access folder) Form W-8 BEN instructions can be found in SAPPHIRE (direct download) or the Internal Revenue Service websiteCompleting Form 8233

Completing Tax Treaty Statement/Article

Completing Form W-8 BEN