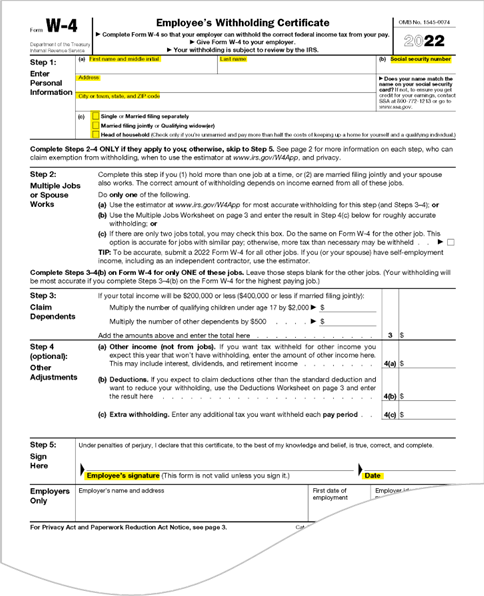

The Employee’s Withholding Certificate (IRS Form W-4) is used to determine the correct federal income tax withholding for an employee. This is a required form for all employees. See the Nonresident Alien Paperwork Manual (Coming soon!) for further instructions for NRAs completing the W-4 or NRA W-4.

Information from an employee's W-4 is populated in SAP infotype IT0210.

SAPPHIRE (direct download) or the Internal Revenue Service website

Step 1 and Step 5 of the W-4 must be completed in entirety by the employee. Step 2, Step 3, and Step 4 will only be completed by the employee if applicable. Required: Step 1: Enter personal information: First name and initial, Last name, Social Security Number, Address, Selection of one of three checkboxes - "Single or married filing separately," "Married filing jointly OR Qualifying widow(er)" or "Head of Household" Step 5: Employee's signature Completed if applicable: Step 2: Information related to Multiple Jobs or Spouse Works Step 3: Claim dependents Step 4: Optional Other Adjustments Page 1 of the W-4 is the only page that should be submitted with the new hire paperwork. Pages 2-5 of the W-4 provide additional instructions, a worksheet, and other information that an employee may find useful if they have any questions. The employee’s signature is required and acknowledges the information on the form is accurate. Ongoing changes to an employee’s W-4 should be made by the employee in Firefly (Employee Self Service > W-4 Form). NOTE: Departments may not help employees complete their W-4 but should instead direct them to the IRS website if they have any questions; https://www.irs.gov/.Completing the W-4