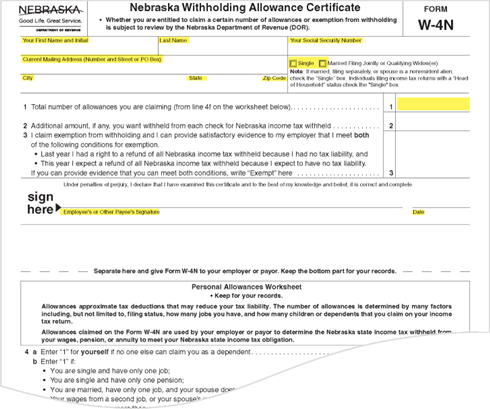

The Nebraska Withholding Allowance Certificate (Nebraska Form W-4N) is used in conjunction with the Nebraska Circular EN to determine the correct Nebraska income tax withholding for an employee. This is a required form.

Information from an employee's W-4N is populated in SAP infotype IT0210.

SAPPHIRE (direct download), or the Nebraska Department of Revenue website

Completing the W-4N

The top half of the W-4N must be completed in entirety by the employee except for items number 2 and item number 3, which may be left blank as determined by the employee. Item 2 allows the employee to indicate an additional amount they would like to have withheld from their pay; and in item 3, the employee can claim exemption from withholding, but must provide supporting documentation that shows the employee had no Nebraska income tax liability last year and that they expect to receive a full income tax refund because they have no income tax liability this year. If an employee is claiming exempt (writes “Exempt” in Step 3), Step 1 and Step 2 must be blank

The top half of the W-4 N required information includes the following information about the employee: first name and initial, last name, social security number, current mailing address, a checkbox indicating single or married filing status, and completion of item number 1 in which the employee indicates the total number of allowances they are claiming.

Page 1 (or just the top portion) of the W-4N is the only page that should be submitted with the new hire paperwork. The bottom half of the W-4N, along with pages 2-3, include additional instructions and information that an employee may find useful if they have any questions.The employee’s signature is required and acknowledges the information on the form is accurate.

Ongoing changes to an employee’s W-4N should be made by the employee in Firefly (Employee Self Service > W 4 Form)

NOTE: Departments may not help employees complete their W-4N but should instead direct them to the Nebraska Department of Revenue website if they have any questions; https://revenue.nebraska.gov/about/forms/income-tax-withholding-forms.