When an error or delay occurs that makes it necessary to issue to the employee a "special check," a payroll check issued outside of the regular payroll processing cycle, the HR professional must initiate the special check process.

UNL Business Centers and financial staff are responsible for completing a Payroll Special Request form on behalf of their departmental clients and employees, when appropriate. When and how a payroll special check request may be completed is described below.

Standard Payroll vs. Special Check

The University issues payroll payments in accordance with payroll schedules developed by the Payroll Office Administrative Services Group (ASG), as described in UNL’s Establishment of Payroll Schedules policy. It is most efficient and cost-effective to process payroll and payroll corrections for all employees through standard payroll processing procedures and established payroll schedule. However, in rare instances of financial hardship, it may be appropriate for an employee or department on behalf of the employee to request a payroll special check.

A Payroll Special Check is a manually-issued paper payroll check issued for an employee outside the regular payroll processing cycle. Issuing payroll special checks is time and labor intensive. However, in some circumstances, a special check may be issued to correct an error in an employee’s pay, issue pay due upon termination, or correct paperwork processing delays. Other acceptable reasons may be determined by UNL Payroll Services.

Payroll special checks will not be provided for the following:

- Overloads or additional payments above and beyond regular salary

- Leave payouts (except for a nonresident leaving the country)

- Relocation allowances

- First paychecks delayed for reasons other than departmental or payroll office error

Prevent the Need for a Special Check

Following all standard payroll procedures is the best way to ensure that all employees are paid correctly and according to the established payroll schedule, thereby avoiding the need for payroll special checks. The following actions should be taken to prevent the need for a special check:

- Business Centers or other financial staff should regularly review payroll reports. The Monitoring Dates Report and Future Separations Report may be used to anticipate the need for completion of a personal action form (PAF). Review Wage & Hour reports to check for potential payroll errors and take action to ensure that correct pay is issued according to the established payroll schedule.

- Remind departments or other UNL hiring officials to notify their Business Center or other appropriate human resources staff of all new hires early in the hiring process to allow sufficient time to complete the on-boarding process and data entry that facilitate payroll.

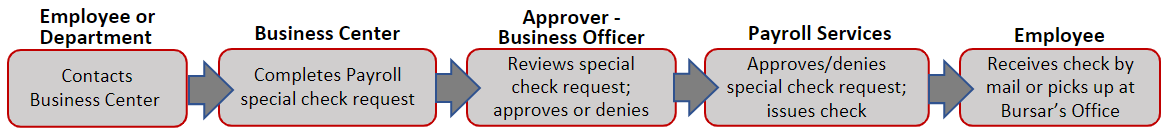

Payroll Special Check Request Process

- An employee or department contacts their Business Center to request a payroll special check and provides information about the urgency of the employee’s financial situation.

- A Business Center payroll staff member consults with their departmental client or the employee regarding details and financial urgency of the situation. If appropriate, they will complete and submit the electronic special check request. When completing the special check request form, it is important to:

- Include detailed information about what caused the payroll issue and about employee’s financial hardship that would warrant the issuance of a special check.

- Indicate if the employee wants to receive the check by mail or pick it up at the Bursar's Office

- The applicable Business Officer reviews and approves/denies the payroll special check request.

- Payroll Services reviews the request and, if appropriate, proceeds with issuance of the special check, which will either be available for the employee to pick up at the Bursar's Office or will be mailed to the employee, as requested by the employee. If mailed, it takes approximately 10 business days to receive a special check after it has been processed by Payroll Services.

History

Updated: August 11, 2023