When an employee receives more pay than they have earned, UNL Business Centers and financial staff are responsible for contacting the employee to work out a method for repayment and for submitting an Overpayment Request form to Payroll Services. The overpayment resolution process is described below.

Identifying Overpayments

Regular review of the Wage and Hour Report during the payroll cycle will help identify overpayment situations. The most common causes of overpayments include:

- Employee separations that are submitted late.

- Graduate students who have graduated but are not separated.

- Timecard reporting errors.

- Errors on rate of pay when employee information is entered or updated in SAP.

- Departments do not notify Business Center staff when an unpaid leave of absence occurs.

Payroll Overpayment Request Process

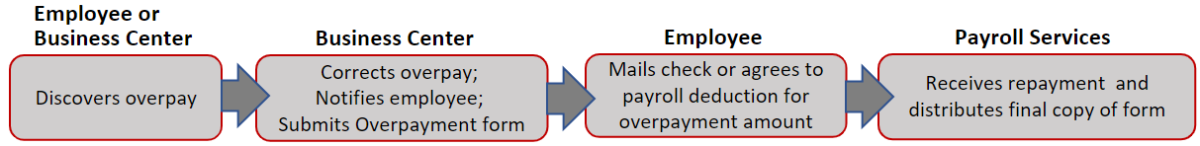

- Upon discovery of the overpayment of an employee, the Business Center contacts the employee to notify them of the

overpayment and to develop a plan for repayment.

- Payroll deduction is the preferred method for the employee to repay the University. The employee can specify if they want the entire amount deducted from their next paycheck if there is sufficient funds to cover the overpay amount on the next payroll cycle. Alternatively, if the employee would like the deduction to be divided over multiple paychecks, please work with the payroll manager to make those arrangements.

- A secondary option is for the employee to write a check payable to UNL.

- The Business Center corrects the underlying cause of the overpayment. Solutions might include:

- Check on the processing status of a submitted PAF.

- Submit a Separation PAF or Update/Change PAF (for an unpaid leave of absence).

- Contact the department to resolve timecard reporting errors.

- Request/enter corrected information in SAP to resolve data entry error.

- Business Center Staff complete and submit the Overpayment form found on Business Central under Online Forms.

- In the “Total Gross Overpay Amount” field, enter the entire amount that the employee has been overpaid.

For example, if a monthly employee was overpaid by $500 a month for two months, the Total Gross Overpay Amount is $1,000. - If an employee is repaying via payroll deduction, please detail the repayment plan. Payroll Services will calculate exact amounts to be deducted from each paycheck based on the details provided in that field.

- If the employee is repaying with a check, the check should be made payable to UNL and mailed to:

Payroll Services, 401 ADMS, Lincoln, NE 68588-0436

- In the “Total Gross Overpay Amount” field, enter the entire amount that the employee has been overpaid.

- The Overpayment form is reviewed and approved by the employee (if repayment is by payroll deduction), Unit Business Officer and Payroll Services.

- Payroll completes the form and an email with a PDF of the form is sent to the business center staff who initiated the form. A copy is also saved on the Business Central SharePoint site.

Prevention of Overpayments

The following actions should be taken to prevent overpayments:

- Business Center payroll staff should regularly review payroll reports (e.g., Wage and Hour, CATS_DA) to check for potential payroll errors and take action to ensure that correct pay is issued according to the established payroll schedule.

- Remind departments and supervisors to notify their Business Center right away of separations (especially graduations) or employment changes to allow sufficient time to complete the necessary processes that impact payroll.

History

Updated: February 27, 2023